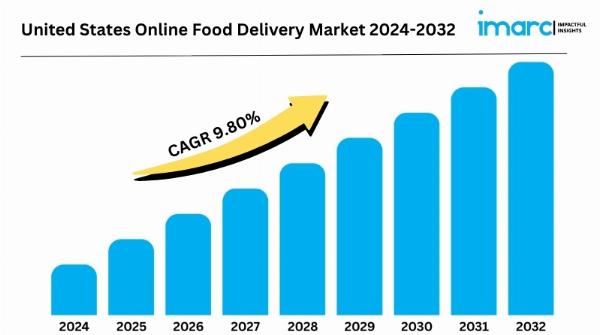

United States Online Food Delivery Market to Expand at a CAGR of 9.8% Over 2024 2032 IMARC Group

United States Online Food Delivery Market Overview

Market Size in 2023: USD 29.1 Billion

Market Forecast in 2032: USD 68.6 Billion

Market Growth Rate: 9.8% (2024-2032)

According to the latest report by IMARC Group, the US online food delivery market size reached USD 29.1 Billion in 2023. Looking forward, expects the market to reach USD 68.6 Billion by 2032, exhibiting a growth rate (CAGR) of 9.8% during 2024-2032. The market is expanding rapidly, driven by increasing consumer demand for convenience and a variety of food options. This growth is fueled by advancements in technology and the rising adoption of food delivery apps and platforms.

United States Online Food Delivery Industry Trends and Drivers:

The United States online food delivery market has seen remarkable growth driven by several key factors. The convenience offered by online food delivery platforms cannot be overstated. With busy lifestyles becoming the norm, consumers increasingly prefer the ease of ordering food from their favorite restaurants without leaving home. This shift in consumer behavior is further amplified by advancements in technology; smartphones and mobile applications make it simpler than ever to browse menus, place orders, and make payments with just a few taps.

The proliferation of high-speed internet access also plays a crucial role, enabling seamless user experiences that encourage repeat orders. Besides this, the growing health consciousness among consumers. Many delivery platforms now offer healthier menu options, including plant-based meals and calorie-conscious choices. This trend caters to the demand for nutritious food, making it easier for health-focused individuals to maintain their diets while enjoying convenience.

In addition to technological advancements and changing consumer habits, the United States online food delivery market is influenced by a growing variety of food options and the emergence of diverse delivery platforms. Consumers today seek diverse dining experiences, and delivery services cater to this demand by partnering with an extensive range of local eateries, from gourmet restaurants to food trucks. This wide selection appeals to different consumer preferences, allowing individuals to explore cuisines they might not typically try.

Furthermore, the rise of ghost kitchens, establishments that prepare food solely for delivery has created an innovative model that lowers overhead costs and allows for a more flexible menu. Marketing strategies, including discounts, promotions, and loyalty programs offered by delivery platforms, have also been instrumental in attracting and retaining consumers. These promotional efforts enhance consumer engagement and foster brand loyalty in an increasingly competitive market. As the industry continues to evolve, these driving factors are likely to shape the landscape of online food delivery in the United States for years to come.

Moreover, the COVID-19 pandemic significantly accelerated the adoption of online food delivery services, as many consumers sought contactless dining options. Restaurants adapted quickly, many partnering with third-party delivery services to sustain their operations during lockdowns, which kept their businesses afloat and introduced new consumers to the convenience of online ordering.

United States Online Food Delivery Industry Segmentation:

The report has segmented the market into the following categories:

Breakup by Platform Type:

Mobile Applications

Websites

Breakup by Business Model:

Order Focused Food Delivery System

Logistics Based Food Delivery System

Full Service Food Delivery System

Breakup by Payment Method:

Online

Cash on Delivery

Breakup by Region:

Northeast

Midwest

South

West

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market.

Major players in the market are actively implementing strategies to uphold and grow their market leadership. Top companies are prioritizing improving user experience with simplified ordering processes, quicker delivery times, and a larger variety of restaurant collaborations. For instance, in June 2023, DoorDash collaborated with major grocery stores such as ALDI, Albertsons, Safeway, Meijer, and 7-Eleven to enable SNAP/EBT payments, increasing accessibility to more than 4,000 sites in the US. This project was designed to address food insecurity and enhance convenience for vulnerable populations, offering SNAP recipients benefits, such as DashPass membership for two months to reduce barriers to fresh groceries. Additionally, there is a strong focus on technological advancement, with a specific emphasis on using AI and ML algorithms to enhance route optimization and predictive analytics to enhance efficiency and lower expenses within the fiercely competitive environment.

Key highlights of the Report:

Market Performance (2018-2023)

Market Outlook (2024-2032)

COVID-19 Impact on the Market

Porter’s Five Forces Analysis

Strategic Recommendations

Historical, Current and Future Market Trends

Market Drivers and Success Factors

SWOT Analysis

Structure of the Market

Value Chain Analysis

Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Ask analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=1247&flag=F

Browse more research report: